-

EconomySep 24, 2021

Privatization in times of crisis: Exploring options for Lebanon’s telecom sector

- Joulan Abdul Khalek

.jpg)

In the midst of Lebanon’s ongoing and historic economic crisis, there is renewed debate regarding the urgency of government privatization in critical economic sectors, including telecom. Privatizing Lebanon’s telecom sector might be seen by some as a quick-fix to the country’s public debt crisis; however, without significant market reform that can promote true competition and encourage continuous investment in the sector, any sale of public assets will likely have a limited impact on the economy.

Further complicating matters, due to Lebanon’s ongoing economic crisis, the financial return of any privatization effort will likely be severely curtailed as the continued decline in the foreign exchange rate of the Lebanese pound negatively impacts the valuation of state-owned enterprises in the telecom arena. On the other hand, the need for Lebanon to jumpstart its telecom sector, which in turn can help stimulate the economy, has never been more pronounced. This leads us to somewhat of a paradoxical situation: privatization is an attractive option that can help unleash Lebanon’s telecom sector, but without significant market reforms and in the midst of a catastrophic economic crisis, privatization is not likely to have any significant positive economic impact.

In order to elaborate on this seemingly complex situation: First, I would like to outline the rationale behind encouraging private sector participation in telecoms. Second, I evaluate the prospects of telecom sector liberalization without privatization as a first step in that direction. Third, I discuss current prospects for privatizing Lebanon’s telecom sector and explore the impact of the ongoing economic crisis on the valuation of state-owned enterprises. Finally, I conclude by making recommendations regarding possible steps that can be taken toward full liberalization of the sector in the near future.

1. The case for private-sector participation in the telecom sector

The Government of Lebanon (GoL) is unable to single-handedly sustain the financial requirements of a world-leading and cutting-edge telecom sector. In non-resource-rich countries, where government revenues are limited and investments are necessary to stay ahead of the rapidly advancing telecom technology curve, participation of the private sector is essential. Over the past 30 years—despite being heavily indebted and lacking in resources—the GoL has nevertheless directly financed most of its telecom infrastructure through taxpayer money, without any room for private sector participation.

For example, OGERO, the state-owned telecom company’s most recent nationwide fiber optic project was financed by an advance of US$100 million from the Lebanese treasury, approved in 2017 by the Council of Ministers. Today the government’s financial situation is very different than it was in 2017. After officially defaulting on its foreign debt in March 2020 and falling into a deep economic crisis that may continue for a decade, the country’s ability to publicly finance major infrastructure projects is no longer an immediate possibility.

In the case of telecoms, this is not the end of the story. Investments in the infrastructure powering this sector are typically straightforward, come with relatively short-term returns, and are commercially strategic, which has made it an attractive area for private investment globally. Indeed, the world’s largest telecom and technology companies have made headlines this year in their race to upgrade telecom infrastructure across Africa, including fiber connections to underserved areas, data center investments, and mobile network enhancements. In such a market environment, with limited fiscal space and severely curtailed public financing capabilities, it would clearly make more sense for the GoL to focus on other priority areas, particularly if the case for private sector investment in telecoms can be made.

Finally, due to recent advancements in telecom technologies, making commercially successful telecom investments requires a radically different approach in which increased participation by the government and the private sector becomes necessary. Telecom technology lifecycles are typically short-lived, particularly on the access or consumer side of the network. With the advent of 5G and other advanced wireless technologies, such as LoRaWAN or Sigfox, the lines between wireless and fixed-line connectivity are beginning to blur. For example, on a next-generation telecom network, it does not matter whether you are using your mobile phone, personal laptop, a smart TV, or an industrial sensor. Each of these devices, despite belonging to vastly different use cases, communicate with the world, access files in the cloud, and make complex computations, using a combination of fixed-line and wireless telecom network backbone capabilities.

Due to the convergence of what has been traditionally two independent worlds, many legacy government network operators and new private sector players may find themselves at odds. This new industry configuration requires seamless and almost automatic cooperation between public and private players to ensure effective service delivery. This is due to the fact that the telecom networks of the future will be network agnostic, technology neutral, and service based.

2. The contradictions of Lebanon’s Telecom Law 431/2002

If private sector participation is necessary for telecoms, what is the ideal market environment in which private companies should operate? Lebanon’s most recent telecom law (2002) calls for the restructuring and privatization of state-owned telecom assets, the establishment of an independent telecom regulator tasked with enforcing competition, and full liberalization of the sector. However, due to political conflict, weak regulatory enforcement, and corruption, most of the provisions of this law have still not been implemented. Nearly 20 years later, with protesters across Lebanon calling for reform, it might be useful to review some of the main provisions stipulated in Telecom Law 431/2002.

Lebanon’s current telecom law maintains that any individual that meets the minimum legal requirements should be able to invest in, or start, a new company in the telecom space, and to provide services in a competitive environment that is enforced by an independent regulator (Clause IV, Section 20). The regulator is authorized to ensure competition, monitor prices, issue new telecom licenses, determine radio frequency prices, and oversee the modernization of the sector (Clause II, Section 5). The law also outlines the mechanism by which all state-owned telecom assets are transferred to a new vertically integrated state-owned enterprise (Liban Telecom) ahead of its partial privatization with a strategic partner (Clauses VIII and IX).

However, despite these seemingly liberal provisions, the 2002 telecom law nevertheless keeps much of the authority over the sector in the hands of the government, represented by the Ministry of Communications and the Council of Ministers. This includes the issuance of new licenses for mobile operators and international telephone services (Clause IV, Section 19). The law also leaves the issuance of licenses for “new undefined categories of telecom services,” such as next-generation telecom services, subject to interpretation. In addition, revenues for the use of radio frequencies are collected directly by the Ministry of Communications (Clause III, Section 17).

If the government intends to keep majority share of a vertically integrated telecom operator (Liban Telecom) in light of this law, then its ability to make major decisions in the sector place it in a serious conflict of interest with competing private operators. Indeed, successful telecom market liberalization has often been closely related to sufficient checks and balances on the executive power of government, legal integrity, and freedom from corruption. In some countries, liberalization and privatization have been criticized for leading to vertically unregulated private monopolies with high prices and minimal quality improvement.

Despite these contradictions, the intent of Telecom Law 431/2002 is to promote competition. True, transparent and well-enforced competition can help drive down prices and keep costs low. This ensures that network operation, maintenance, and expansion are conducted efficiently, freeing up much-needed capital and labor for other sectors. This has been the major lesson learned from successful privatization programs in many markets around the world (although it is worth noting that most of these markets already had strong competitive practices in place, as well as a high degree of regulatory independence).

3. Prospects for privatization: Estimating the value of state-owned telecoms

Privatizing Lebanon’s telecom sector in the midst of this economic crisis would lead to an unfavorable valuation of state-owned companies and assets. This is primarily due to the deterioration in the value of the Lebanese pound over the past two years. Any corporate valuation in the telecom sector would have to take into account the current exchange rate, as all revenues of state-owned enterprises are in the national currency.

For the sake of this article, I use an exchange rate of LBP 8,000 per US dollar, assuming that any structural reforms implemented in the near term may improve the value of the Lebanese pound and stabilize it. It is worth noting that if the current downward spiral of the lira continues, privatization in telecoms—or any other sector—is just not possible. Therefore, government efforts to stabilize the national currency will not only improve Lebanon’s near-term recovery, but it will also give the state the option of selling public assets in the not-so-distant future.

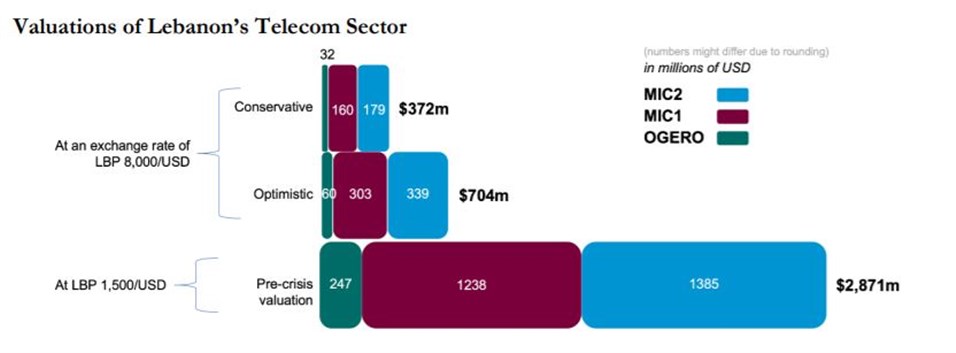

When taking a closer look at the data, it becomes clear that the current crisis has reduced the valuation of Lebanon’s telecom sector by more than 75% in real terms. Assuming a post-crisis exchange rate of LBP 8,000/one dollar, the value of the sector could be somewhere between USD 372-704 million (reflecting a conservative and optimistic estimate, respectively). This compares to a valuation of USD 2.8 billion in the pre-crisis era.

Note: Number of subscribers is derived from individual operator websites and ITU database. Financial data for telecom SOEs (state-owned enterprises) in Lebanon is not publicly available, so I have made some assumptions. Optimistic scenario: ARPU $20 for mobile operators in Lebanon (projection based on 2018 ITU report) and $19 for OGERO (based on Egypt Telecom’s PPP adjusted ARPU for both fixed voice and fixed broadband subscribers). Churn rate and EBITDA margin assumed to be 10% and 25%, respectively. Conservative scenario: ARPUs assumed to be 30% below optimistic scenario. Churn rate and EBITDA margin assumed to be 15% and 20%, respectively. Pre-crisis valuation metrics are based on an average of both scenarios.

Clearly privatizing at much higher (or highly volatile) exchange rates would lead to an extremely low valuation. This would be rather unfortunate for a sector that has been financially lucrative for the Lebanese treasury, averaging USD 1.2 billion in annual revenues between 2016 and 2019. Although Telecom Law 431/2002 calls for the privatization of Liban Telecom, any sale of public assets in the current environment will result in a major loss of revenues to the state treasury.

4. Sector liberalization: A first step in the direction of full privatization

Despite the difficulties related to telecom privatization in the middle of a historic economic crisis, following through on sector reforms today would significantly improve the financial and economic prospects of any future privatization program. It is true that sector liberalization without privatization, as some have argued, can lead to the creation of new companies in the telecom space, thus eroding market share for state-owned companies. However, privatizing publicly-held companies in a fully competitive market environment would likely spark much more interest from both domestic and foreign investors, leading to higher valuations. In addition, liberalizing the sector would force the hand of government owned telecom companies to operate more efficiently, thus boosting both their profitability and valuation.

The impact of sector liberalization on the Lebanese economy would be significant, particularly in a country that still struggles to provide accessible, high-quality, affordable digital services to its population. However, any liberalization agenda would need to take into account the need for an independent regulatory body whose role would be to ensure the continuous development of the sector. Interestingly enough, most of these reform measures are clearly outlined in Telecom Law 431/2002, yet they have either not been implemented at all or applied incorrectly, due to endemic corruption, weak governance standards, and the absence of a robust legal system. In fact, one of the main obstacles to successful privatization in Lebanon is the country’s political environment, whereby successive governments have failed to agree on any meaningful structural economic reform in the past three decades.

5. Recommendations

Despite this reality, there are six steps that can be taken sequentially to improve prospects for telecom privatization in Lebanon:

- Empowering the telecom regulator to take transparent and rule-based decisions regarding licensing, anti-competitive practices, and yearly investments in network development, in accordance with Telecom Law 431/2002.

- Drawing up a simple, national telecom roadmap with clear objectives for the next 5-10 years related to sector development, infrastructure investment, speed, quality, and availability of digital services.

- Passing a new data privacy law that identifies clear standards for the confidentiality of consumer data, organizes the conditions of commercial access to this data, and enforces consumer protection mechanisms in case of privacy infringement.

- Restructuring of all state-owned telecom companies according to Telecom Law 431/2002 in a manner that makes them more competitive and improves their operational capabilities, including the possibility of hiring private sector players to manage them in the interim.

- Full liberalization of the mobile, broadband, and data-center market by allowing domestic and/or foreign private investors to fully enter this space without any prejudice or red tape.

- Full or partial privatization based on a radically transparent and competitive process that is contingent upon the successful restructuring of state-owned companies and the enforcement of clear measures that support sector liberalization and encourage competition.

Joulan Abdul Khalek Joulan Abdul Khalek is an independent Telecom Media and Technology specialist with over 10 years of experience working for international organizations including the World Bank and International Finance Corporation